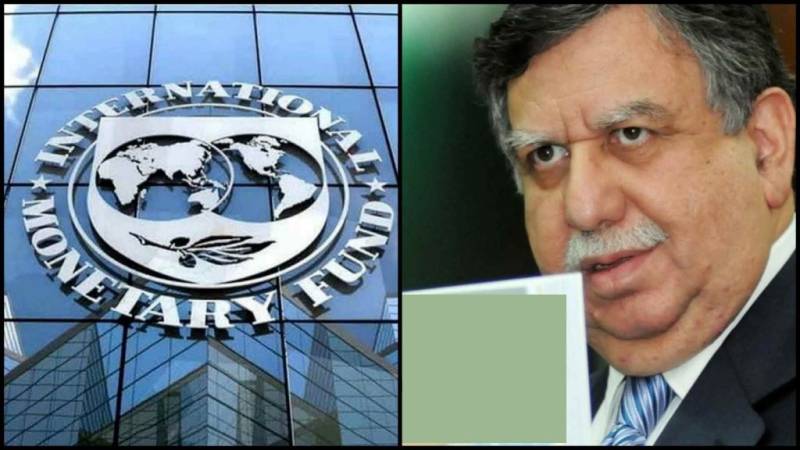

Govt, IMF make ‘compromises’ in three-day talks

Stay tuned with 24 News HD Android App

The government, after three days of negotiations with the International Monetary Fund (IMF), has managed to soften its tough stance on setting high tax targets, increasing electricity tariff and levying more taxes on the salaried class while in return the government had to accept Fund’s condition of levying fixed tax at the rate of 7.5 per cent on all pensioners, reported 24NewsHD TV channel on Tuesday.

In short, both sides managed to get some of their demands accepted during the negotiations which began on May 28 and concluded on May 30.

The IMF, which, during the talks, kept insisting on setting the tax target at Rs6,000 billion in the national budget for the financial year, 2021-22, finally revised the target on the government’s insistence from Rs6, 000 billion to between Rs5, 700 and Rs5,750 billion.

The IMF wanted not only a reduction in the number of slabs of salaried people from 11 to five but also wanted an additional tax of Rs300 billion to be levied on them.

Although the government agreed to reduce the number of slabs to five, it did not accept the international money lending organisation’s condition of levying additional tax on the salaried class.

Similarly, it accepted the Fund’s condition of increasing the adhoc allowance of employees rather than increasing their basic pay.

Likewise, the government also agreed to IMF’s demand of increasing the income tax target by 30 per cent; that of excise duty by 29 per cent; of sales tax by 30 per cent and customs duty by 12 per cent.

During the negotiations, the government conveyed to the IMF officials its plan to cut excise duty on the tobacco sector by 10 per cent, arguing this would augment tax revenue.

Besides that, the government suggested to the Fund officials to cut federal excise duty on cold drinks sector from 13 per cent to 11.5 per cent.

However, the government had to surrender to the toughest condition set by the IMF and that was to levy a 7.5 per cent fixed tax on pensioners.

Now, the government which used to pay Rs250 billion every year in pensions would be able to generate over Rs18 billion revenue by levying 7.5 per cent tax.

During the talks, Minister for Finance Shaukat Tarin refused to accept Fund’s condition of increasing electricity tariff, saying this would not only burden the consumers but would also increase the production costs for industrialists, thus adversely affecting the economic growth.

Reporter: Ashraf Khan