Stock markets diverge to end record-breaking year

Stay tuned with 24 News HD Android App

Stock markets diverged on Friday on the final trading day of a year during which major indices hit record highs as inflation cooled.

Wall Street retreated near midday, a day after the Dow Jones Industrial Average reached a fresh high and the broad-based S&P 500 almost hit a new record.

The Dow was nevertheless over 13 percent up for the year and the S&P 500 was nearly 24 percent higher.

US equities had trended higher since late October as the market has embraced moderating inflation and a strong labour market in the belief the US economy can avoid recession.

Investors expect the US Federal Reserve to start cutting interest rates next year after a series of hikes aimed at taming consumer prices.

"Many signs point to an economy that can weather rate hikes as air continues to deflate from the inflation balloon," analysts at Charles Schwab investment firm said in a note.

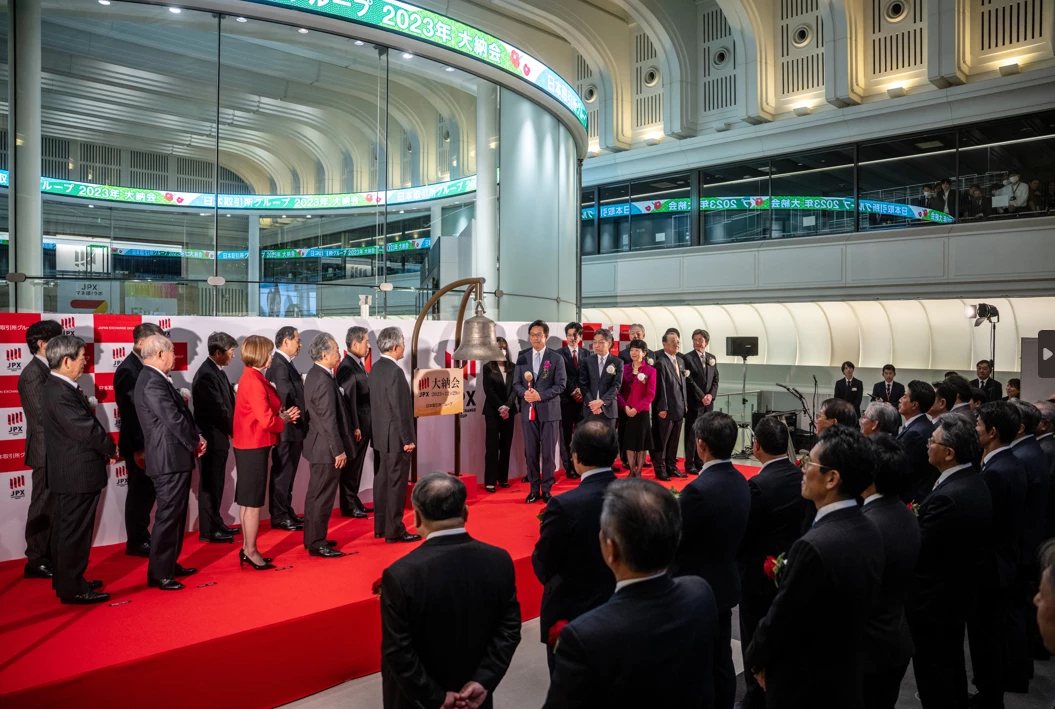

In Asia, Tokyo's benchmark Nikkei index finished lower on Friday but surged more than 28 per cent overall in 2023, its best performance for a decade.

European stock markets finished the year on a high note, with London, Paris and Frankfurt all closing in the green ahead of the extended New Year holiday weekend.

Frankfurt registered a yearly gain of 20.3 per cent and Paris 16.5 per cent, having recently hit record heights.

London, however, gained less than four per cent in 2023.

The FTSE 100 index has "moved largely sideways for the year, thanks in large part to extreme uncertainty and the upwards march of interest rates" in the UK, said Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown.

"Questions now of course turn to next year's trajectory, and there's every chance (British) inflation is going to remain stubbornly above the Bank of England's target."

Analysts are expecting the BoE to begin cutting interest rates later in 2024 than in the United States and Europe, where inflation has cooled at a faster pace.

In Japan, the Nikkei powered higher this year as "Warren Buffett's comments triggered a reappraisal of Japanese equities", said Masayuki Doshida, senior market analyst at Rakuten Securities.

Buffett told local media in April that he intended to buy additional Japanese stocks, with his Berkshire Hathaway then acquiring shares in five major Japanese trading firms.

"The Nikkei index regained its upward momentum on the back of expectations for structural reforms in domestic companies, a boost to the economy from inbound tourism and the outlook for continued monetary easing policy," Doshida added.

The Bank of Japan has avoided hiking interest rates despite high global inflation, in sharp contrast to other major central banks.

Elsewhere, Chinese stocks have been weighed down by concerns regarding the country's sluggish economic recovery from its long-lasting and strict pandemic lockdowns.

Still, there was positive news in the Chinese tech sector on Friday, with Huawei saying it expected 2023 revenue to grow by nine per cent, despite facing continuing US sanctions.

Global oil prices rose Friday amid disruptions to Red Sea shipping. Yet, "crude oil is set for its biggest yearly decline since 2020", said Swissquote Bank senior analyst Ipek Ozkardeskaya.

"OPEC's efforts to curb production and the rising geopolitical tensions in the Middle East remained surprisingly inefficient to boost appetite in oil this year."

The year also saw gold hit record heights, with the precious metal profiting from its status as a haven investment in times of economic and geopolitical unrest.