Pakistan's GDP to remain below 3% in next three years: World Bank

Stay tuned with 24 News HD Android App

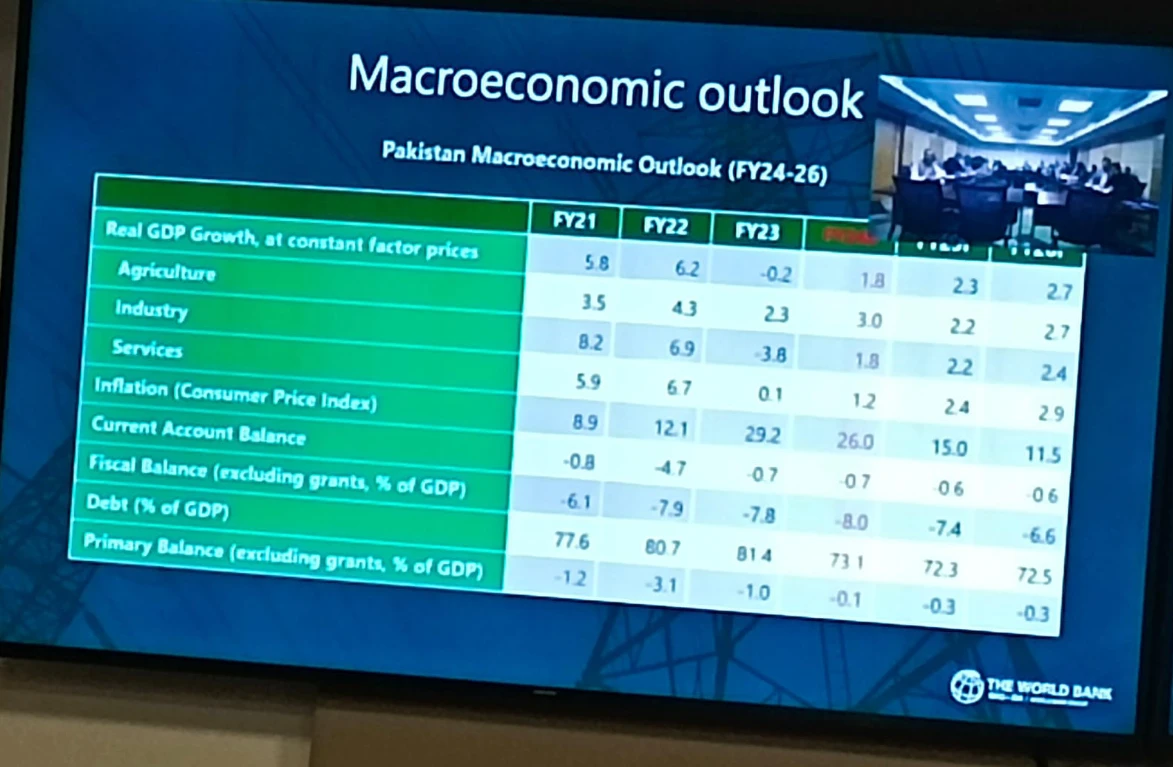

The World Bank has predicted that Pakistan's gross domestic product (GDP) to remain below 3 percent in the next three years while during the current fiscal year the growth rate may touch 1.8 percent, however in 2025 growth will remain around 2.3 percent, reported 24NewsHD TV channel.

According to World Bank's latest outlook report on Pakistan released on Tuesday, the subdued recovery reflected the tight monetary and fiscal policy and muted economic activity amid weak business confidence.

The World Bank predicted a decline in inflation next year which was likely to be 26pc this fiscal year. Inflation may reach 15 percent in fiscal year 2025.

However, inflation was expected to drop down to 11.5 percent in fiscal year 2026. World Bank report further said industrial growth may remain around 1.8 percent during thr current fiscal year.

According to the WB report, agricultural growth was likely to touch 2.2 percent in 2025 and 2.7 percent in 2026. While industrial growth was expected to remain 2.2 percent in FY 2025 and 2.4 percent in 2026.

While fiscal deficit was expected to reach 8 percent of GDP this fiscal year. While fiscal deficit was expected to be 7.4% of GDP in fiscal year 2025 and 6.6 percent of GDP in fiscal 2026.

However, after a contraction in FY23, Pakistan’s economic activity has strengthened over the first half of FY24 on the back of strong agricultural output.

This, together with improved confidence, also supported some recovery in other sectors. But growth remains insufficient to reduce poverty, with 40 percent of Pakistanis now living below the poverty line.

Macroeconomic risks remain very high amid a large debt burden and limited foreign exchange reserves.

"The structural reforms needed to durably improve the economic outlook are known. Developing a clearly articulated reform implementation plan that is ambitious, credible and that shows quick progress is now essential to restore confidence," said Najy Benhassine, World Bank Country Director for Pakistan.

In addition, the IMF report recommends establishing new guarantee issuance rules, mitigating credit risks, ensuring adherence to International Financial Reporting Standards, and developing risk monitoring procedures.

All State-Owned Enterprises (SOEs), including those under the State Wealth Fund (SWF), should be covered under the purview of the SOE Act to ensure financial transparency and good corporate governance practices.

The World Bank report also highlighted the high fiscal costs of federal state-owned enterprises (SOEs) and the critical reforms needed to improve their performance, efficiency, and governance, including via privatizations.

The World Bank report said a sustained medium-term recovery will require a prudent macroeconomic policy mix coupled with reforms to improve the quality of expenditures, broaden the tax base, address regulatory constraints to private sector activity, reduce state presence in the economy-including via privatizations, address challenges in the energy sector, and increase public investments to improve human development outcomes. The Update includes a list of key reforms in ten areas that should be considered for priority implementation to initiate a strong, durable, and poverty-reducing economic growth recovery.

"The current macroeconomic outlook projects growth that is below Pakistan's potential, with little poverty reduction and continued erosion of living standards," said Sayed Murtaza Muzaffari, lead author of the report.

"Risks to this outlook remain high, including uncertainty around policy commitments and reform implementation, financial sector risks, potential increases in world energy and food prices in the context of intensification of regional geopolitical conflicts, slower global growth, and tighter than expected global financing conditions."

The outlook report highlighted the high fiscal costs of SOEs operating in key sectors of the economy. These SOEs have been consistently making losses since 2016, and the government has been providing significant financial support through subsidies, grants, loans, and guarantees, leading to large and growing fiscal exposure.

Reporter: Waqas Azeem