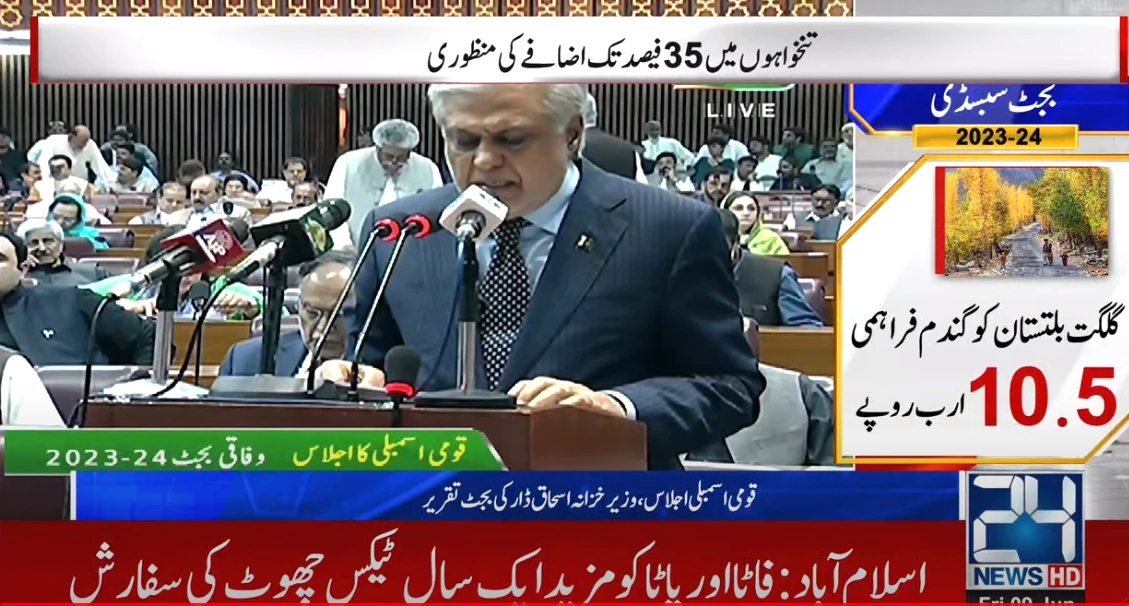

Finance Minister Ishaq Dar presents Rs14 trillion budget with no new tax

Stay tuned with 24 News HD Android App

Finance Minister Ishaq Dar Friday presented the Rs14.46 trillion budget for the fiscal year 2023-24 (FY24) in the National Assembly while setting a modest growth target of 3.5%.

The NA session began with a recitation of the Holy Quran followed by the national anthem. Prime Minister Shehbaz Sharif is also in attendance.

Dar began his speech by recounting the achievements of the PML-N’s previous government under Nawaz Sharif.

He accused the previous PTI government of the current economic fiasco and also presented a review of the three years tenure of the PTI government.

Dar said that when the coalition government took over from the PTI in 2022, the country’s economy was in dire straits, with forex reserves depleting and the IMF programme in the doldrums.

The finance minister said for the next year, GDP growth had been budgeted at 3.5 per cent, terming it a “modest target”. He said that this budget is “not an election budget” and is focusing on the “elements of the real economy”.

Dar said agriculture is the backbone of the economy and this budget is placing special attention on this sector. He then went on to list some of the special measure taken for the agri sector, primary among which was increasing agri loans from Rs1.8 trillion to Rs2.25 trillion.

Current expenditure

The government has budgeted total current expenditure at Rs13,320bn for FY24, which is 53pc higher than last year’s budgeted figure.

Defence expenditure is budgeted at Rs1,804bn, 15.4 per cent higher than last year, making up 1.7pc of GDP.

Interest payments, or debt servicing, budgeted for FY24 have risen a whopping 85pc from last year to Rs7,303bn — making up the single largest expenditure of the government, accounting for 55pc of total current expenditure.

Current account deficit

Pakistani economy's second major problem is the current account deficit, which he said, swelled to $17.5 billion during the fiscal year 2021-22.

The finance minister mentioned that due to the "prudent decisions of the incumbent government" — majorly due to the import curbs — the CAD has been reduced by 77% to $4 billion.

Likewise, he said, the trade deficit has been reduced by $21 billion.

"The threat of default has been averted due to the tough decision of the government and fall in foreign exchange reserves has been slowed down," the finance minister said.

Federal revenue

Total revenue budgeted for FY23 stands at Rs12,163bn.

After subtracting provincial transfer of Rs5,276bn, net revenue comes out at Rs6,887bn, which is 36.9pc higher than last year.

FBR tax target

The finance minister said Rs7,200 billion are likely to be collected in tax revenue — and the provinces' share would be Rs4,129 billion during the next fiscal year.

He said FBR is expecting to collect Rs1,618 billion from non-tax revenue, and federal tax collection will be Rs4,689, while total expenditure is estimated at Rs11,090 billion.

‘No new tax this year’

Finance Minister Dar said no new tax is being imposed this year, and all efforts are being made to provide relief to the masses.

He said the government is trying to increase employment opportunities and introduce policies to promote the ease of doing business.

Dar said industries and exports should be encouraged to play their part in increasing the country's foreign exchange reserves.

Dar said imposing taxes on the rich is the leading principle of the government's taxation policy, and the tax was imposed on high-earning individuals.

Besides, he added that the 10% super tax was imposed on 15 businesses and sectors earning up to Rs150 million in the last budget.

He said measures had been proposed to convert the super tax into progressive taxation by increasing its tax percentage.

Dar-led Ministry of Finance has proposed the imposition of a 10% withholding tax on the bonus shares (in-kind dividend) as the finance minister said that some companies, in order to skip taxes, issue bonus shares instead of cash dividends.

Fiscal deficit

Fiscal deficit, or overall budget deficit, which is the difference between the government’s total expenditure and revenue is calculated as:

Gross Revenue at Rs12,163bn (minus) Transfer to Provinces Rs5,276bn (plus) Provincial Surplus Rs650bn (minus) Total Expenditure Rs14,460bn.

For FY23, overall deficit is budgeted at Rs6,923bn, which is 6.54pc of GDP. Last year, the deficit was budgeted at 4.9pc of the GDP.

PSDP

The finance minister said that through the Public Sector Development Programme (PSDP), the government proposed an allocation of Rs1,150 billion (including Rs200 from PPP) mode, while for the provincial programme, Rs1,559 have been proposed.

Salient features of the proposed allocation of PSDP:

80% partially completed projects will be prioritised.

52% PSDP allocated for attracting foreign direct investment.

For balanced growth among various cities, Rs108 billion have been allocated.

Moreover, the government has decided to pay special attention to the projects in Balochistan.

Key Budget Points

- No new Tax

- No increase in duties on the import of essential items.

- Enhancement of monetary limit of foreign remittance remitted from outside Pakistan from Rs5 million to rupee equivalent of $100,000.

- Waiver of 2% final withholding tax on purchase of immovable property for nonresident individual POC/NICOP holder where immovable property is acquired through foreign remittances remitted from abroad.

- Rationalisation of Super Tax under section 4C to apply on all persons across the board on income above Rs. 150 (m): insertion of additional three new income slabs of Rs350(m) to Rs400(m), Rs400(m) to Rs500(m) and Rs500(m) above to be taxed at 6%, 8% and 10% respectively.

- Exemption of customs duties on raw materials of diapers, sanitary napkins.

- Reduction of customs of 10% to 5% on non-localised (CKD) heavy commercial vehicles (HCVs).

- 5% tax on payments made through credit or debit cards to restaurants resorts.

- Withdrawal of sales tax return filing requirement for availing concessionary fixed tax rate of 0.25% for IT & ITeS exports.

- Five years tax holiday for agro-based industries being SMEs set up on or after July 1, 2023, from tax year 2024 to tax year 2028.

- Exemption of customs duties on specific papers and art cards and board for printing of Holy Quran.

- Duty-free import of IT-related equipment equivalent to 1% value of their export proceeds.

- Withdrawal of capping of the fixed duties and taxes on the import of old and used vehicles of Asian Makes above 1,300cc.

- Grant of exemption of sales tax on contraceptives and accessories.

- The requirement of shop area for tier-1 retailers is proposed to be withdrawn.

- Re-imposition of 0.6% advance adjustable withholding tax on non-ATL persons on cash withdrawal.

Dar said the guiding principles for this year’s taxation policy are: To encourage exports of IT and IT enabled services; To encourage foreign remittance in order to boost foreign exchange reserves; To encourage local industry for economic growth and development; To encourage construction, SMEs, Agriculture sector; To encourage youth entrepreneurship in view of the youth bulge in our country; To digitize the economy to broaden the tax base; To tax the rich and affluent segment of society; To provide relief to the poor which is badly needed in view of inflation; and to increase cost of transactions for non-filers.

Exports of IT & IT enabled Services

To enhance exports of IT and IT enabled Services and increase foreign exchange remittance in Pakistan, it is proposed as under:

- a) Concessionary rate of tax @ 0.25% to continue for tax years 2024 to 2026.

- b) Exemption certificate for timely payment to non-resident persons is proposed to be automated and issued within 30 days of filling of exemption application online.

- c) Requirement of filing of sales tax return relaxed in order to claim tax concession @ 0.25%.

- d) IT freelancer of below USD 24,000 per annum exports in previous financial year will be exempt from filing of sales tax returns in ICT (Islamabad Capital Territory) and will file simplified one page income tax return.

- e) Reduction of GST on services from 15% to 5% for IT and ITeS in Islamabad (ICT).

- f) Concessionary tax rate of 20% for banks advancing loans to IT & ITeS sector and inclusion of IT and ITeS sector in SME concessionary tax regime.

- g) Duty free import of capital goods valuing equivalent to 1% of export by IT & ITeS sector.

Relief on remittances

The finance minister said remittances are a crucial part of foreign exchange reserves, representing 90% of the country's exports.

In a bid to promote remittances through formal channels, the government has proposed the following steps:

Abolishment of 2% final tax on the purchase of immovable property.

Introduction of a "diamond card" for people sending over $50,000 — through which they can get one non-prohibited bore license, gratis passport, preferential access to Pakistani embassies and consulates, fast-track immigration at Pakistani airports, special prizes through draws.

Education measures

Highlighting the importance of education, the finance minister said that although this falls under provincial jurisdiction, the federal government always plays its part.

For the Higher Education Commission (HEC), the federal government has proposed an allocation of Rs65 billion under the current expenditure, while Rs70 billion have been allocated for under the development expenditure.

It was also revealed that Pakistan Endowment Fund would be established for the financial aid of the sector, for which Rs5 billion have been allocated in the budget.

Meanwhile, under the Prime Minister Laptop Scheme, the federal government has decided to distribute 100,000 laptops to merit-based deserving students, and for this, the cabinet has proposed to allocate Rs10 billion

Incentives for Construction Sector

Construction sector is one of the main pillar of economic growth as more than 40 allied industries are connected to this sector. In order to provide incentives to the builders and individuals to construct new houses and buildings, it is proposed to provide a 10% reduction in tax liability or Rs. 5 million whichever is lower, for business income of construction enterprise and 10% tax credit or Rs. 1 million whichever is lower, for individuals constructing their houses for three years for tax year 2024 to tax year 2026. This concession will apply to new construction projects started w.e.f. 01.07.2023 onwards. However, land development is excluded from this concession.

Encouraging Youth Entrepreneurship in the Country

Youth in our country require special attention of the government because youth of today is the future of this country. They can contribute a great deal in the national growth and development of the country. Therefore, to encourage youth entrepreneurship a 50% reduction in tax liability on business income of a youth enterprise for new business in case of individual and AOP and in case of company is proposed for 3 years. This reduction in tax liability on business income should not exceed Rs. 2 million in case of individual and AOP and Rs. 5 million in case of company. Youth individual in this regard is a natural person up to the age of 30 years and youth enterprise is a start-up established on or after first day of July, 2023 as sole proprietorship concern owned by a youth individual or an AOP or a company by youth individuals. This would naturally encourage youth independent involvement in business activities and young business leaders would emerge having innovative business ideas.

Promotion of construction, agriculture and SMEs

To incentivize banks to increase lending to priority sectors (construction, SMEs, agriculture), a concessionary tax rate of 20% is currently applicable on segmented income of banks against standard rate of 39% for tax year 2020 to tax year 2023. It is expiring with the close of tax year 2023. It is proposed to extend the concessionary regime by 2 years i.e. for tax years 2024 and 2025. It would boost agricultural and industrial sectors of economy.

To broaden the scope of SMEs concessionary tax regime, threshold is increased from Rs. 250 (m) to Rs. 800 (m). To encourage listing of the Companies minimum tax of listed companies is reduced to 1% from 1.25%

To Boost exports of agriculture and non-agriculture products including marble, gems, metals, etc. a reduced rate of 1% on local purchases is provided as an incentive for export through online market place covered in export facilitation scheme.

Energy needs

Dar said Pakistan depends on imported fuel to meet energy requirements, and the government is determined to promote solar energy and the use of local coal.

Several measures have been proposed to meet the energy needs:

Coal-powered power plants have been instructed to use local coal.

Raw materials of solar panels, inverters, and batteries are being exempted from custom duties.

To resolve of issue of fuel shortage due to disruption in global fuel supply chain, “Bonder Bulk Storage Policy” is being introduced under which foreign suppliers using their own resources will import the fuel to store it in the fuel storage.

Refinery and oil marketing companies will be allowed to buy oil from the storage facility.

Increase in WH Tax Rates on supply of goods, rendering of services and execution of contracts

Most of the economic activities involve supplies of goods, execution of contracts and provision of services. In order to capture and enhance governmental revenues from these transactions, there is a proposal to increase WHT rates on supplies, contracts and services @ 1% for individual/AOP and company. Moreover, the concessionary rate of 3% tax on services is proposed to be increased to 4%. This increased in rates is not applicable rice, cotton seeds, cooking oil, print and electronic media and sports persons.

Rationalization of Scope and Tax Rates of Super Tax U/S 4C

Taxing the rich is one the guiding principles of taxation policy of Pakistan as mentioned earlier. Therefore, Super tax on high earning person was imposed during tax year 2022. It was a graduated rate from 1% to 4%. Moreover, super tax was imposed @10% on 15 specified sectors which are revenue yielding sectors and businesses. Income threshold for the purposes of super tax was Rs. 150 (m). It is therefore proposed to levy progressive super tax across the board, starting from 1% on income between Rs 150(m) to Rs 200(m) to gradually increase to 10% for income of Rs 500 million and above.

Rationalization of WH Tax Rates on Commercial Imports

Commercial importers pay minimum tax at the time of imports as compared to the industrial undertaking who pay tax on their profits. Therefore, to rationalize the effective tax rate (minimum tax) on income from import of goods by commercial importers as subsequent consumption and profitability is not captured, tax rate is proposed to be increased from 5.5% to 6% on other goods imported by commercial importer.

WHT on Bonus Shares Issued by Companies

Some companies issue bonus shares to avoid taxation instead of paying cash dividend. Therefore, in order to encourage companies both listed and non-listed to pay dividends in cash and thereby contribute in tax revenue on dividends, it is proposed to impose withholding tax @ 7.5%. The law existed before and was omitted through Finance Act 2018.

Tax on Cash Withdrawal from Non-ATL Persons

Taxing cash withdrawal is an important source for the documentation of economy. Therefore, in order to document cash withdrawal by Non-ATL persons and to increase cost of transactions for Non-ATL persons, it is proposed tax @ 0.6% on cash withdrawal exceeding Rs. 50,000. The law existed before and was omitted through Finance Act 2021

Imposition of WHT on Foreign Domestic Helper

Approximately 10,000 foreign domestic helpers employed as domestic help in Pakistan by affluent class. Average payment per domestic help USD 6,000 per annum. It is proposed to levy 15% WHT on payment to domestic helpers. Authority issuing the work permit shall collect tax from the employer.

To discourage outflow of foreign Currency

There is a need to not only increase it but also plug the loopholes responsible for its decrease. Therefore, to discourage outflow of foreign currency through use of credit/debit cards and banking channels, it is proposed to increase WHT on foreign payments from 1% to 5%.

Dar said Pakistan is passing through a difficult financial phase. There is inflation on one hand, requiring government intervention to support the poor; the government is suffering from extreme financial crunch on the other hand for which raising more revenues through taxes is the primary option. Indirect taxes are generally considered to affect common man. Taking lead from the vision of the Prime Minister, the government intends to tax the elite – the rich – who have the power to pay so that incidence of Sales Tax and Federal Excise is borne by the affluent and government provides breathing space to the poor.

Sales Tax & Federal Excise Measures

It is proposed to increase GST to 15% from present 12% on supplies made by Tier-1 retailers of Textile and Leather products. This will primarily be a tax on branded, high value added products of textile and leather apparel and products. It will be a tax on brand savvy class of the society who can afford latest fashion, expensive products. Similarly, consumer goods sold with trademarks and under brand names including spices, dairy products, poultry and packed fish etc. in whatever type of packing, are proposed to be taxed @18%. This will not affect common man and yet provide revenues to the government.

Milk and fat filled milk sold under a brand name or a trade mark is presently charged @ 0% GST is proposed to be charged GST at reduced rate of 9% as a VAT regime, as other branded products which are consumed by the affluent are already taxed @ 18% e.g. butter, cream, chees, flavored milk etc. However, unpackaged milk sold in open market without a brand will remain exempt.

Sales Tax on Harvesters, combined harvester, saplings, seeds for sowing (already exempt in Islamabad) is proposed to be exempted.

Rate of Federal Excise duty on Telecom services is proposed to be reduced from 19.5% to 16%.

One of the key areas of concern of the present government is to have inter province harmony and a harmonized tax regime in Pakistan. After the 25th amendment to the Constitution of the Islamic Republic of Pakistan in 2018, FATA and PATA have been merged with KP and Balochistan under the previous PMLN Government. It is the duty of this government to ensure that this Constitutional change is operationalized effectively. In order to provide relief to the people of these areas and to avoid sudden impact of taxes, exemption from sales tax was granted for a period of five years which is ending this year in 2023. This exemption is extended to tax year 2024.

Coming to relief measures, last year relief was provided to Allopathic medicine by imposing tax rate of 1%. However, unani and herbal medicines that are primarily used in rural areas and by poor masses were taxed @18%. It is proposed to extend this relief on Herbal and Unani medicines as well from last year. This will be a relief for common house-hold.

As regards Tier-I retailers, covered area has always been a bone of contention between the taxpayer and the tax collector. In order to streamline retail sector and provide relief to retail sector which will ultimately trickle down to common man, the condition of covered area is proposed to be removed from the sales tax law.

In order to encourage digital payments in Islamabad Capital Territory, while making payments through credit cards for availing restaurant services, tax rate has been proposed to be reduced to 5% from the standard rate of 15%.